Health Insurer Financial Performance Amid the Coronavirus Pandemic

The coronavirus pandemic, social distancing, and the resulting economic downturn have had a significant impact on the U.S. healthcare system, including health insurers. The pandemic resulted in a significant decline in health service use in the first half of 2020, the loss of jobs appears to have resulted in a loss of coverage in the employers' market and an increase in Medicaid enrollments, and insurers having to pay for the Forecast next year need to assess the relative impact of the pent-up demand for late care, the ongoing pandemic, and a possible vaccine.

In this letter, we analyze data from 2013 to 2020 to examine how insurance markets performed in the first half of this year as the U.S. pandemic developed and worsened. We use financial data reported by insurance companies to the National Association of Insurance Commissioners and compiled by Mark Farrah Associates to determine the average claims rates and gross margins in the individual (also known as non-group), fully insured (employer), and Medicare Advantage markets – Investigate health insurances. A more detailed description of each market can be found in the appendix.

We note that at the end of June 2020, average margins increased and claims ratios in the fully insured groups and Medicare Advantage markets decreased compared to the same period in 2019. If management costs were roughly the same in 2020 as in 2019, these results suggest that many insurers are seeing higher profits during the pandemic. Individual market loss rates were already quite low and remained unchanged through 2020, suggesting continued profitability. The results for the individual and group markets show that commercial insurers are on the right track to again owe consumers significant discounts next year under the determination of the Medical Loss Ratio of the Affordable Care Act (ACA).

Gross margins

One way to assess the insurer's financial performance is to examine the average gross margins per member per month, or the average amount by which premium income exceeds claims costs per subscriber in a given month. Gross margins are an indicator of performance, but positive margins don't necessarily translate into profitability as they don't take into account administrative costs. However, a sharp increase in margins from one year to the next without a corresponding increase in administrative costs would indicate that these health insurance markets have become more profitable during the pandemic.

Although many insurers are paying the full cost of coronavirus testing and treatment for their participants, claims costs for insurers have decreased in most markets and margins have increased since the pandemic began and compared to 2019. This is in line with the sharp drop in usage documented in other analyzes.

Gross margins under the group market plans increased 22% (or 20 pmpm) in the second quarter of 2020 over the same period in 2019. Gross margins under the Medicare Advantage plans also rose, increasing 41% (or 64 pmpm) for the first six months of 2020 compared to gross margins at the same point in time last year. (Gross margins per member per month for Medicare Advantage tend to be higher than other health insurance markets, mainly because Medicare covers an older, sick population with higher average costs.) Before the pandemic, margins in the Corporate and Medicare Advantage markets were in the has increased gradually in recent years.

Figure 1: Average gross margin per member per month up to June 2013-2020

Individual market margins have been more volatile than other private markets since the early years of the Affordable Care Act (ACA), as detailed in our earlier analyzes of individual market financial performance. Individual market margins remained relatively stable for the first six months of 2020, declining only $ 4 per member per month and staying much higher than in the ACA's earlier years. These data suggest that insurers in the retail market will remain financially healthy after a year and a half without an individual mandate penalty, even if the coronavirus outbreak worsened.

Medical loss rates

Another way to evaluate the insurer's financial performance is to look at medical claims ratios, which are the percentage of premium income that insurers pay out in the form of medical claims. In general, lower medical claims ratios mean that after medical expenses are paid, insurers have more income to use for administrative expenses or to keep as profit. Each health insurance market has different administrative needs and costs. So low claims ratios in one market do not necessarily mean that the market is more profitable than another market. However, in a given market, if administrative costs remained broadly constant from one year to the next, a decline in loss ratios would mean the plans become more profitable.

Medical claims ratios are used in a number of ways in state and federal insurance regulation. In the commercial insurance markets (individual and group insurance), insurers are required to provide discounts to individuals and businesses if their loss ratios do not meet the minimum standards set by the ACA. Medicare Advantage insurers are required to report loss ratios at the contract level. They also have to grant the federal government discounts if they don't reach 85% and are subject to additional penalties if they fail to meet the claims ratio requirements for several consecutive years.

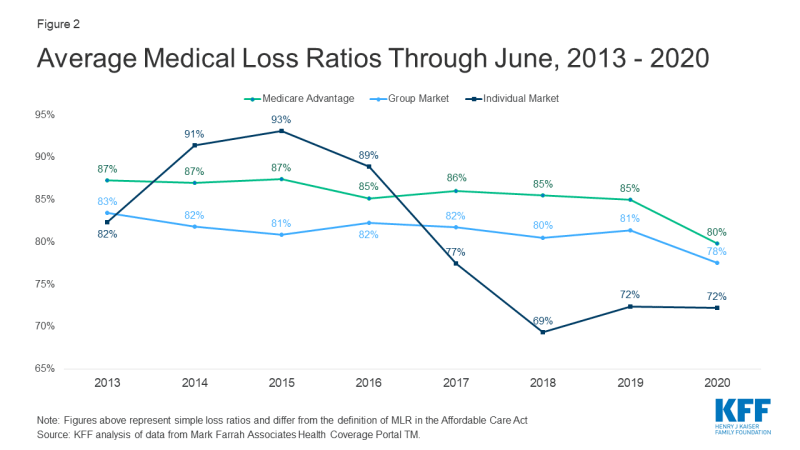

The loss ratios listed in this edition differ from the definition of the MLR in the ACA, which makes some adjustments for quality improvements and taxes, and do not take into account reinsurance, risk corridors or risk adjustment payments. The graph below shows simple medical claims ratios or the share of premium income that insurers pay out in claims without compensation (Figure 2). The claims ratios in the Medicare Advantage market decreased 5 percentage points in the first six months of 2020 compared to the same period last year, and the claims ratios in the group market decreased an average of 3 percentage points year over year.

Figure 2: Average medical loss rates up to June 2013 – 2020

The individual market was the only market in which the average loss ratios remained constant compared to the previous year. Even so, claims rates in each market were already quite low, and insurers in that market are giving consumers record-breaking discounts, based in part on their 2019 experience.

discussion

While we cannot measure profits directly, all signs suggest that health insurers have become more profitable in most markets so far during the pandemic. Medicare Advantage and group health plans saw increasing margins and decreasing loss ratios through June 2020 compared to the same period last year. In contrast, the margins and loss ratios of the individual market insurers remained generally unchanged in the second quarter compared to the same period last year, although the insurers in this market already had high margins and low loss ratios last year.

That insurers appear to be more profitable during a pandemic may be counter-intuitive. Insurers generally had to bear the cost of COVID-19 testing, and many voluntarily paid the full cost of COVID-19 treatment for a period of time (see, for example, announcements from UnitedHealthcare, CVSHealth (Aetna), and Cigna). Despite this increased spending related to pandemics, many insurers saw claims costs decline as participants delayed or waived other types of health care due to social distancing restrictions, the suspension of voting procedures, or fear of contracting the virus. Job loss and economic instability can also affect health care utilization.

The decline in utilization, which has contributed to higher gross margins and lower medical claims ratios, presents insurers with uncertainty and challenges, especially given the unknown course of the pandemic. For Medicare Advantage insurers, these trends may result in plans that offer more benefits than they currently do, are popular and attract participants. However, if insurers fail to meet the necessary claims ratio requirements for several years, they face additional penalties, including the possibility of termination. In individual and group markets, insurers report pandemic uncertainty when setting premiums for the next year, and insurers make different assumptions about how far utilization will recover or health costs will change due to factors such as the potential for widespread vaccination will .

Unless these patterns change materially in late 2020, ACA's medical claims ratio discounts in 2021 commercial markets are likely to be exceptionally high. The discounts for consumers are calculated using a three-year average of the medical loss rates. This means that the discounts for 2021 are based on the performance of insurers in 2018, 2019 and 2020. In the individual market in particular, insurers were quite profitable in 2018 and 2019. Even if 2020 turns out to be a more average year, these insurers are likely to owe huge discounts to consumers. Group market insurers can also owe employers and employees larger discounts than planned in typical years, as the loss ratios have dropped significantly. This could partly explain why many commercial insurers volunteered to cover COVID-19 treatment costs, decided not to split telemedicine costs, or expanded psychiatric services during the pandemic. By increasing their claims costs, insurers can proactively increase claims ratios and owe smaller discounts over the next year.

Comments are closed.