How the American Rescue Plan Will Improve Affordability of Private Health Coverage

The American Rescue Plan (ARP), recently signed into law by President Biden, increases and extends eligibility for ACA (Affordable Care Act) premium subsidies for those participating in market health plans. The law also creates new, temporary premium subsidies for COBRA continuing coverage. and it temporarily changes the rules for year-end tax reconciliation of market premium subsidies. These changes will make coverage more affordable for those already enrolled on market health plans, and allow millions more the opportunity to re-enroll for coverage with increased financial assistance this year.

Extended Marketplace Premium Subsidies

As part of the ARP, the premium subsidies for the ACA market for people of all income levels will be increased significantly and will be offered for the first time to people with an income above four times the federal poverty line (FPL).

Individuals with up to 150% FPL can now receive silver plans for zero premium with greatly reduced deductibles. Previously, market premium subsidies were partial; No matter how poor the people were, they had to contribute to the cost of the benchmark silver plan (i.e., the second lowest silver plan in their region). Individuals earning 100% FPL were required to put 2.07% of household income ($ 264 per year in 2021) into a benchmark plan. At 150% FPL, that amount rose to 4.14% of household income ($ 792 per year). Under ARP, the Benchmark Market Plan is now fully subsidized for individuals earning up to 150% FPL. At this income level, the cost-sharing subsidies were already the most generous (the average silver plan deductible for those with 150% FPL is $ 177 this year). As a result, low-income people can now qualify for premium-free silver plans with modest deductibles for covered health benefits.

Premium subsidies will also be increased for those with higher incomes among those currently eligible for assistance on incomes up to 400% of the poverty line. Bonus tax credits increase for individuals at all income levels. (Figure 1) Individuals earning 200% FPL were required to contribute $ 1,664 towards the cost of the Benchmark Marketplace Plan that year. Now they only have to contribute $ 510 under the ARP. With an income of 400% FPL, employees were required to contribute up to $ 5,017 towards the benchmark plan award. Now they don't have to contribute more than $ 4,338 to this plan.

Figure 1: Average Annual Benchmark Premium ($ 5,409) Contribution and Tax Credit for a 40-year-old in 2021 under ACA and ARP

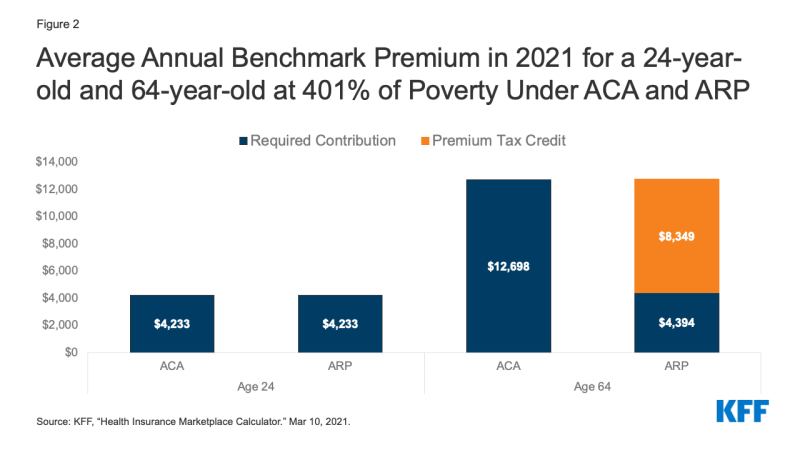

Individuals with an income of more than 400% FPL are now entitled to market premium subsidies. Under the ACA, individuals with an income of more than 400% FPL were not eligible for market premium subsidies. Now they don't have to put more than 8.5% of household income into the benchmark plan. This change will bring limited relief to younger market participants – for example, for 24 year olds in most areas, the unsubsidized benchmark retirement plan already costs less than 8.5% of the income for someone with 401% FPL – but it does to significant relief for the elderly, where the unsubsidized premium averages nearly 25% of household income for someone with the same income level who is 64 years old. (Figure 2) Before this change, some individuals with income greater than 400% FPL bought their insurance off-market or bought non-ACA-compliant plans (e.g. short-term policies) when they were not eligible for premium subsidies. These individuals may want to return to the market where coverage may now be more affordable and comprehensive. The Biden Administration has reopened the market registration until May 15th.

The ARP reward improvements are effective in 2021 and 2022. These changes to the market premium subsidies are temporary and only apply to the calendar years 2021 and 2022. The details and timetable for the implementation of these changes remain to be determined. However, once implemented, current participants may be able to log into their marketplace account to increase the amount of APTC (Advanced Premium Tax Credit), thereby lowering their monthly health insurance premium payment for the remainder of this year. Subsidies for current participants apply retrospectively to the beginning of this calendar year and can also be claimed as a tax refund if people file their tax return for 2021 in the next year.

In the states of HealthCare.gov, current participants can also change their plans during the COVID registration period, which currently runs until May 15, 2021. Individuals represented in government marketplaces should check with their marketplace for information about their ability to change plans when the new premium subsidies are introduced. Currently, some government marketplaces offer a COVID registration period during which only uninsured people can register.

Figure 2: Average annual benchmark premium in 2021 for a 24-year-old and a 64-year-old at 401% of poverty under ACA and ARP

Improved subsidies for the unemployed

The ARP provides expanded market subsidies for those receiving or receiving Unemployment Insurance (UI) benefits over the course of a week in 2021. The ARP extends the current federal surcharge (USD 300 per week) to state UI benefits until September 6, 2021.The federal UI addition is not taken into account when determining eligibility for Medicaid or CHIP.

If UI recipients apply for market subsidies, special rules apply in 2021.

Household incomes greater than 133% FPL will not be taken into account when determining eligibility for market premiums and cost-sharing grants in 2021. As a result, those who receive UI benefits anytime in 2021 will be eligible for a zero-rewards benchmark silver plan with extensive cost-sharing subsidies that year.

Individuals receiving UI benefits will be considered "Applicable Taxpayers" in 2021. Typically, an individual must qualify under the ACA as an “Applicable Taxpayer” who must have an income of at least 100% FPL in order to receive market grants. Under the ARP, people receiving UI benefits are only applicable taxpayers for the year 2021. This may help some UI recipients on incomes below the federal poverty line who live in states that have not adopted the ACA Medicaid extension. Otherwise, they were in the “coverage gap” that was out of the question for both Medicaid and market subsidies.

These extended market subsidies for UI recipients only apply to the reporting year 2021.

Congress should enact more legislation to extend UI subsidy improvements beyond this year.

Individuals who receive UI benefits must meet other requirements in order to be eligible for market subsidies. In particular, married people must file a joint tax return in order to be eligible for subsidies. Using divorce filing status generally makes an individual ineligible, although there is an exception for those suffering from domestic violence.

In addition, those receiving UI benefits may still not be eligible for market grants if they have access to job-related health benefits that meet ACA's affordable and minimum value standards. The affordability of job-related coverage will continue to be measured in terms of household income, including UI benefits and amounts above 133% FPL.

Premium Tax Credit Payback Vacation for 2020

When individuals apply for market premium grants, they do so based on their estimated annual income for that tax year. Later, when filing federal tax returns for that year, people will have to balance their actual income with the amount of tax credit they received based on the estimated income and repay some or all of the excess premium tax credit ( or receive an additional tax credit if Actual Income Was Lower Than Expected. Amount of Repayment Ceilings apply. However, if Actual Income exceeds 400% FPL, Individuals must repay the full amount of Excess Bonus Tax Credit received during the year.

Given that the 2020 pandemic resulted in above-average economic disruption and uncertainty, the ARP is waiving the repayment of tax credits that market participants received this year.

Implementation questions still have to be answered. Before the ARP went into effect, the Internal Revenue Service (IRS) had already completed tax forms and plans for 2020, which include an APTC vote and excess loan repayment. Further action by the IRS is likely to be forthcoming to educate the public about this new protection, provide advice on how to use it when filing a 2020 tax return, and reimburse amounts to anyone who may have already filed their 2020 tax return with repayments.

Temporary COBRA award subsidies for 2021

The ARP provides temporary COBRA premium subsidies for up to 6 months in 2021. The subsidies cover 100% of the monthly cost of COBRA as long as individuals are eligible. The law stipulates that the previous employer must pay the COBRA premium for those eligible for subsidy. The federal government reimburses the former employer for these costs.

The COBRA premium subsidies for coverage months can be paid on April 1, 2021 at the earliest and September 30, 2021 at the latest. The grant may end before September 30th. It ends when the COBRA cover is exhausted. For example, someone who was first eligible for COBRA due to a layoff on March 1, 2020, could continue that plan for 18 months or through August 2021. That person could apply for the COBRA premium grant starting April 2021, but the subsidy would stop when COBRA is depleted in late August. People also lose eligibility for the COBRA Premium Grant once they are eligible for other job-related coverage. In this case, users must notify their COBRA plan administrator, otherwise there is a risk of being fined.

The grant applies to people whose COBRA qualification event includes termination of employment or reduction in working hours. People are not eligible for the COBRA grant if they voluntarily quit. You will also not be eligible for subsidies if COBRA resulted from any other qualifying event, including the death or divorce of the insured employee, the insured employee's claim to Medicare, or loss of dependent child status.

Individuals previously eligible for COBRA in the pandemic will still be able to choose. Typically, individuals have up to 60 days from their qualifying tournament to choose COBRA Continuing Coverage. However, during the pandemic, people will have extra time to choose COBRA thanks to COVID disaster relief from the Ministries of Labor and Finance. Your new COBRA term is (1) one year from the date the person's term would otherwise have expired, or (2) 60 days after the announced end of the COVID National Emergency. For example, a person who was laid off in early 2020 and whose deadline to vote for COBRA was April 1, 2020, will now have until April 1, 2021 to vote for COBRA. In the future, a new candidate for COBRA can extend their term of office for up to 1 year (or up to 60 days after the end of the national emergency, whichever is earlier). This contingency rule applies to the election of COBRA based on any qualifying event.

Individuals eligible for COBRA earlier in the pandemic can begin reporting prospectively. Typically, COBRA coverage will be based on the Qualifying Event of your choice and premiums must be paid retrospectively up to that point. This remains the rule for those eligible for subsidy whose qualifying event takes place on or after April 1, 2021

Within the framework of the ARP, however, a special rule applies to persons eligible for subsidies whose COBRA qualification event occurred before the ARP came into force and who have not yet voted for COBRA. or for such persons, if they previously selected COBRA, but discontinued it later and are otherwise still eligible for COBRA. If these individuals choose COBRA, coverage will begin on the first day of April 2021. Your COBRA coverage will not go back to prior to that date and you will not owe any COBRA rewards prior to that date.

Eligible persons who have already paid for COBRA when the law was passed can also apply for the grant.

COBRA award grants are not counted as individual income. Subsidies do not affect an individual's tax liability or entitlement to other income-related benefits.

Individuals eligible for COBRA subsidies may also be eligible for market subsidies or Medicaid. Eligibility for COBRA alone does not affect an individual's eligibility for Market Subsidies or Medicaid. Those with a choice will want to weigh their out-of-pocket expenses (for rewards and cost-sharing minus subsidies) as well as any differences in provider networks, benefits covered, and other plan features. Once a person signs up with COBRA, they will generally not have the option to choose market coverage until after the COBRA coverage begins at the start of the next open registration period or until the time they have exhausted the COBRA coverage.

When the COBRA premium subsidies end, individuals can continue unsubsidized registration with COBRA. Of course, for many, unsubsidized COBRA may prove unaffordable for many. Generally, if a person cancels COBRA (or stops paying the COBRA premium) before it is exhausted, that loss of coverage does not entitle a person to a Special Enrollment Period (SEP) in the market.

However, the market has extensive powers to recognize new SEP qualification events. It remains to be seen whether HealthCare.gov and government marketplaces will recognize the end of COBRA premium subsidies as a qualifying event and allow people to switch to cheaper market plans and subsidies at that point.

Other ARP changes and affordability

Stimulus payments – The ARP provides for business stimulus payments of up to $ 1,400 for eligible individuals in 2021. These payments are considered tax credits and are not counted as income for purposes of tax liability or eligibility for income-related programs and benefits.

Federal income tax exemption for UI benefits in 2020 – The ARP also included a provision that exempted the first $ 10,200 in UI benefits paid to an individual in 2020 from being included in that individual's Adjusted Gross Income for that year, thereby also making the eligible income for the For the purposes of market premium subsidies. As a result of this change, individuals who entered the market in 2020 may be eligible for higher tax credits than during the year. In this case, individuals can receive unclaimed 2020 APTC as a refundable tax credit when filing their 2020 income tax return. People who submitted their 2020 return before the law came into force should also be able to request the refund.

Next Steps?

These significant changes to make private coverage more affordable came into effect after many people had already signed up for market plans for 2021, after HealthCare.gov and state marketplaces announced a limited-time special COVID registration option and after the 2020 tax return season on road. It will take time for federal and state agencies to implement these changes, including updates to market subsidy licensing systems, creating sample notifications, and revising tax forms. The Department of Health and Human Services has announced that the extended ACA premium subsidies will be available through HealthCare.gov from April 1st. However, other changes in the ARP may take longer. During the current special COVID registration period, attendees have until May 15 to re-register for coverage or change plans to receive the additional help.

Comments are closed.