Medicaid Enrollment & Spending Growth: FY 2020 & 2021

The central theses

The coronavirus pandemic has sparked both a public health crisis and an economic crisis that is having a significant impact on the Medicaid countercyclical program. During the economic downturn, more and more people are signing up for Medicaid, which can increase program spending while reducing government tax revenues. In order to both support Medicaid and provide broad tax relief as revenues have plummeted, the Families First Coronavirus Response Act (FFCRA) approved an increase in the Federal Available Match Rate ("FMAP") by 6.2 percentage points (retrospectively January 1, 2020) if states meet certain requirements for maintaining eligibility (CEE). The health and economic impact of the pandemic, as well as the temporary surge in FMAP, were major drivers of Medicaid enrollment and spending as states ended fiscal 2020 and began fiscal 2021 (which began July 1 for most states).

This summary report analyzes Medicaid enrollment and spending trends for FY2020 and FY2021 based on data collected by Medicaid state directors as part of the 20th Annual Medicaid Director Survey in all 50 states and the district of Columbia were deployed. A total of 43 countries had replied to the survey by mid-August 2020, although the response rates for certain questions were different. The method used to calculate enrollment and spending growth and additional information on Medicaid funding can be found at the end of the report. The main results include:

- After a relatively flat growth in enrollments in FY2020 (0.04%), states responding to the survey expect Medicaid enrollments to rise in FY2021 (8.2%), reflecting the FFCRA's MOE requirements and the end the economic downturn that began in the 2020 financial year.

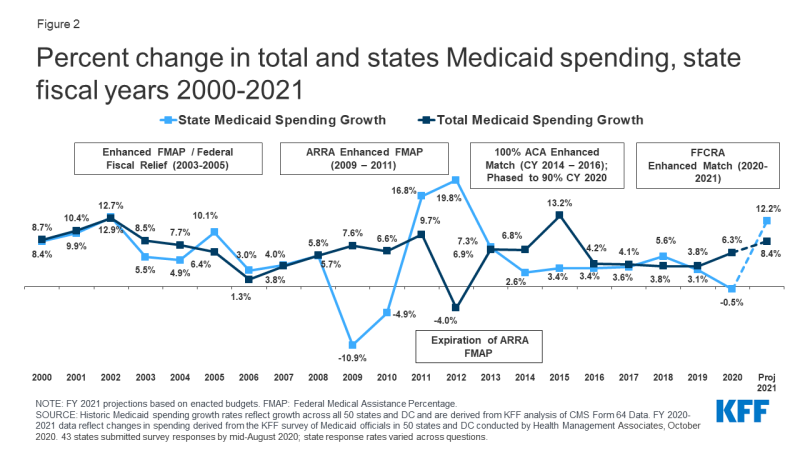

- In all reporting states, states expected total Medicaid spending growth to accelerate to 8.4% in FY2021, compared to 6.3% growth in FY2020. Enrollment was the main factor driving upward pressure on spending growth in the Fiscal year 2021 was identified.

- While expected government spending for Medicaid is critical to government budgets, the projections in this year's survey don't provide a clear picture, as increased federal funding due to the recent public health emergency renewal is expected to expire in late March 2021 (PHE), later than states had generally accepted. At the time of the survey, states estimated that state Medicaid spending would decrease in FY2020 (-0.5%) and then increase sharply in FY2021 (12.2%), with most states assuming the extended matching fund would expire by December 2020.

- Looking ahead, states face much uncertainty about how the pandemic will unfold and the economic downturn, as well as the length of the expanded FMAP and the outcome of the November elections.

context

Medicaid (along with CHIP) cared for about one in five Americans, or about 73.5 million people, in May 2020. Medicaid's total spending in fiscal 2019 was $ 604 billion, with 64.4% paid by the federal government and 35.6% funded by states. Medicaid accounts for one in every six dollars spent on healthcare and more than half that for long-term services and support.

Prior to the pandemic, state tax conditions were strong in fiscal 2020. Unemployment was low, governments were expecting revenue growth for the tenth consecutive year, and general government fund spending increased by 5.8% as planned. In this context, the governors had prepared budget proposals for fiscal year 2021, which included projections for continued growth in income and expenditure. The governors' budgets are usually released at the beginning of the calendar year.

The pandemic resulted in a dramatic reversal in state budget conditions. Early estimates suggest that states are facing large deficits. Some estimates show government budget deficits of up to $ 110 billion for FY2020 and up to $ 290 billion for FY2021. Other early reports from states also show a decrease in government revenues of up to 15% in FY2020 and up to 30% for FY2021 compared to pre-pandemic state estimates of $ 913 billion for FY2020 and $ 944 billion for FY2021. Given the ongoing uncertainty surrounding ongoing revenue collections and the possibility of additional fiscal ones Federal Reliefs Several states passed temporary budgets or rolling resolutions at the beginning of FY 2021, while a few other states with previously adopted budgets for FY 2021 planned to convene special sessions to adjust the budget. In contrast to the federal government, states have to meet balanced budget requirements. Faced with large losses of revenue due to the economic impact of the pandemic, states can use reserves or cut spending when additional federal support is not available. During the Great Recession, states imposed layoffs or vacation days on government employees, cut funding for state governments, made general spending cuts and program cuts for education, higher education, and Medicaid. However, larger cuts in government services and labor can be detrimental to citizens with increased demand for services and also weaken efforts to recover from the economy. To reduce Medicaid spending during the economic downturn, states typically turn to restrictions on provider tariffs and benefits. However, as providers face lost revenue and participants are at increased health risk due to the pandemic, these cost control methods may not be as practical.

While the FMAP increase included in the FFCRA supports Medicaid and provides states with extensive tax breaks, it is unlikely to fully offset declines in government revenues and fully address deficits in the national budget. In the past, the federal tax break by increasing Medicaid's FMAP – or the proportion of the cost of Medicaid paid by the federal government – has helped support Medicaid and provide states with efficient, effective, and timely tax breaks during significant economic downturns . The Families First Coronavirus Response Act (FFCRA) also uses this model by temporarily changing the Medicaid FMAP by 6.2 percentage points from January 1, 2020 through the end of the quarter that the public health emergency (PHE) ends elevated. This FMAP increase does not apply to the ACA expansion group, for which the federal government already bears 90% of the costs. To be eligible for the funds, states cannot introduce more restrictive Medicaid eligibility standards or higher premiums than those in effect from January 1, 2020, must provide ongoing eligibility to participants through the end of the month of the emergency period, and cannot impose shared costs Use of COVID-19-related testing and treatment services, including vaccines, specialty devices, or therapies. States are accessing the expanded funds by filing requests for federal reimbursement of Medicaid expenses.

While all states are under the fiscal stress associated with the pandemic, experiences vary between states. For example, while the national unemployment rate was 8.4% in August 2020 (a decrease from the original high of 14.7% in April 2020 at the start of the pandemic), there were significant state disparities in unemployment with state rates ranging between 4.0% (4.0%). Nebraska) to 13.2% (Nevada). California, Hawaii, New York, Rhode Island, and Nevada had the highest state unemployment rates, outperforming the national rate by three percentage points or more. Similarly, projected revenue shortfalls vary between states, with states reporting a drop in sales of between 1% and 15% in fiscal 2020 and between 1% and 30% for fiscal 2021.

Main results

Trends in enrollment growth FY 2020 and FY 2021

After declines in fiscal 2018 and 2019, followed by relatively flat growth in enrollments in FY2020, states expect Medicaid enrollments to increase in FY2021 (Figure 1). Medicaid registration growth peaked in fiscal 2015 due to the introduction of the ACA and has declined every year since then. Enrollment decreased in fiscal 2018 (-2.1%) and fiscal 2019 (-1.7%), and was relatively flat in fiscal 2020 (0.04%). For the 2021 financial year, however, the reporting countries are forecasting a sharp increase in enrollments to 8.2%. Some states noted that projections prior to the pandemic were closed and did not take into account the economic downturn, so those were likely to change. Others noted uncertainties about when the requirements for PHE and the associated maintenance of effort (MOE) would end, which would allow beneficiaries who no longer meet eligibility standards to resume redeterminations and cancellations of eligibility (although fewer participants likely to see an increase in income due to the economic situation downturn). Some states that recently passed or implemented the Medicaid expansion expect a larger increase in enrollments.

States largely attributed the projected increase in enrollments in the 2021 financial year to the FFCRA's MOE requirements and the economic downturn. All reporting countries replied that the CEE was putting upward or significant upward pressure on enrollment, and almost all reporting countries found that the economy was putting upward or significant upward pressure on enrollment. The two factors (CEE and economy) are probably related. Outside of the MOE, individuals may lose Medicaid coverage because circumstances change (such as an increase in income), because they fail to complete renewal processes or paperwork even if they are still eligible, or because they are out of time aging. or age-restricted entitlement category (e.g. pregnant women or former young people in care). Due to the economic downturn, fewer participants are likely to have higher incomes, which means they will continue to be eligible for Medicaid regardless of the MOE. States anticipate that groups more sensitive to changes in economic conditions (e.g. children, parents, and other adult expansionists) will grow faster than the elderly and people with disabilities. However, an aging state population was also identified as a key factor for enrollment in nearly half of the reporting states. In last year's survey, states linked a decline in pre-pandemic enrollment growth to a more resilient economy, but also to process and system changes, including changes to renewal processes, improved eligibility systems, and improved data reconciliation efforts to verify eligibility.

Figure 1: Percent Change in Medicaid Spends and Enrollments, Government Fiscal Years 1998-2021

Trends in spending growth FY 2020 and FY 2021

Among reporting countries, total Medicaid spending grew by 6.3% in fiscal 2020 but is expected to grow to 8.4% in fiscal 2021 (Figure 1). High rates of enrollment growth, associated first with the Great Recession and later with the implementation of the ACA, have been the main drivers of all Medicaid spending growth over the past decade. Similarly, the decline in enrollments due to a strong economy was the main driver behind the slow growth in Medicaid spending in fiscal year 2019. While enrollment growth remained nearly unchanged in fiscal 2020, spending was in line with the medicaid spending growth over the past two decades. In last year's survey, Medicaid officials said the growth in total Medicaid spending for fiscal 2020 was largely driven by rising costs for prescription drugs (especially specialty drugs) and rate increases (most common for managed care organizations, hospitals and care facilities) All in all, it was linked to medical inflation, pressures from an aging national population, and a case mix with increased visual acuity.

In fiscal 2021, nearly all states expect an increase in enrollments to put pressure on overall growth in Medicaid spending, with additional upward pressure from spending on long-term services and support and changes in provider rates. In addition, about three-quarters of states said utilization was a factor in Medicaid spending: just over half of those states identified utilization as upward pressure on projected spending, while the rest of the states said utilization was downward is expected (probably due) to pandemic-related usage reductions). While many reporting countries were uncertain or believed that the likelihood of a Medicaid budget deficit was “50-50”, overall more countries considered that a budget deficit was “likely” or “almost certain” versus “unlikely”. Hence, it is possible that current spending growth projections may be lower than the actual experience of the states.

It is estimated that government Medicaid spending would decrease (-0.5%) in FY 2020 and increase sharply in FY 2021 (12.2%), before the last renewal of the PHE, which extends the expanded FMAP to March 2021 (Figure 2). The expanded FMAP under the FFCRA was retroactive to January 1, 2020 (mid-way through most government fiscal years). The tax relief expires at the end of the quarter in which the Public Health Emergency (PHE) ends. On October 2, 2020, the PHE was extended from October 23, 2020 to January 21, 2021, with the extended FMAP remaining in force until March 2021. However, states passed budgets for fiscal 2021 ahead of the final extension of the PHE, with most states anticipating the extended FMAP to end by December 2020 or earlier. The expected expiry of the expanded FMAP in 2020, as well as the general increases in Medicaid base spending expected in fiscal year 2021, resulted in an increase in forecast government spending.

Figure 2: State Percentage Change in Total and Medicaid Spending, Fiscal Years 2000-2021

Nearly all reporting states said that federal tax breaks are being used to support the costs associated with increasing Medicaid registration and addressing Medicaid or general budget constraints. Around two thirds of the reporting countries stated that the tax breaks are also used to reduce provider rates and / or cut benefits. The state share of Medicaid spending typically grows at a rate similar to that of total Medicaid spending growth, unless the state matching rate changes. During the Great Recession, government spending on Medicaid declined in fiscal 2009 and 2010 as the American Recovery and Reinvestment Act (ARRA) gave tax relief to the temporary increase in the federal match rate. Government spending soared when this tax break ended. During other economic downturns (including the Great Recession), states typically turn to providers' fee and benefit restrictions to lower Medicaid spending. These cost control methods may not be available as viable for providers facing revenue shortfalls due to the pandemic and for subscribers who are at increased health risk due to the pandemic.

Conclusion and outlook

States face much uncertainty about how the pandemic and economic downturn will unfold. Several states had passed temporary budgets or rolling resolutions to start fiscal 2021, while other states noted that state budgets for fiscal 2021 had not yet been approved. Some states planned to convene special sessions to make budget adjustments, noting that further budget cuts were planned or likely in fiscal 2021. In contrast to the federal government, states have to meet balanced budget requirements. Faced with large losses of revenue due to the economic impact of the pandemic, states can use reserves or cut spending when additional federal support is not available. To reduce spending during the economic downturn, states usually turn to providers' tariff and service restrictions. However, with providers facing revenue shortfalls and subscribers facing increasing health risks due to the pandemic, these cost control methods may not be as practical. Currently, states cannot restrict enrollment and must provide ongoing coverage to current attendees in order to access the improved Medicaid Match Rate in the FFCRA.

Looking ahead, states are also unsure about the duration of the PHE and the expanded FMAP, whether Congress will consider additional fiscal relief, and the outcome of the elections. It is unclear whether the PHE will be extended beyond January 21, 2021. The states have called and the House has passed laws to increase the amount and duration of these federal tax breaks. So far, however, the Senate has not taken these provisions into account. Additionally, the November US presidential election could have a significant impact on Medicaid, with goals for Medicaid and the ACA differing widely between President Trump and former Vice President Biden. Beyond the presidential elections, it will be important to monitor the outcome of the state elections (both the governors and the composition of the state elections).

Comments are closed.