Trends in Overall and Non-COVID-19 Hospital Admissions

Newly available data shows that the increase in the number of COVID-19 cases in the fall of 2020 was accompanied by a decrease in non-COVID-19 hospital admissions during that period. Our analysis includes medical records of hospital admissions through December 5, 2020 from the Epic Health Research Network, and updates a previous paper that analyzed hospital admission data through August 8, 2020. This new data provides additional information to help assess the economic impact of the COVID-19 pandemic on hospitals and insurers also helps us understand the extent to which people are delaying or forgoing care almost a year after the pandemic began. We analyze trends in the total number of hospital admissions and then separately analyze the non-COVID-19 admissions in total and by patient region, age and gender. We calculate the actual approvals as a proportion of the forecast total approvals in 2020 based on trends over the past few years. The main results include:

- The total number of hospital admissions declined to 69.2% of projected admissions in the week leading up to April 4, 2020 – the lowest point of the year – before rising again and staying at or above 90% since June 2020. From the week ending December 5, 2020 the total number of approvals was 94.2% of the forecast values.

- The decrease in hospital admissions from March 8 to December 5, 2020 represents 8.5% of the total expected admissions for 2020 as a whole.

- In November 2020, as COVID-19 cases increased, non-COVID-19 hospital stays began to decline again, accounting for about 80% of projected hospital stays by the end of the month. This suggests that due to the pandemic, people may again delay or abandon care, in some cases likely due to hospital capacity constraints.

- Based on our data through early December, the most recent drop in non-COVID-19 approvals was greatest in the Midwest and West. In both regions, non-COVID-19 approvals at the end of November were around 76% of projected levels as COVID-19 cases rose sharply in many parts of those regions.

This new analysis is based on data from the Epic Health Research Network (EHRN) electronic health record (EMR) data and covers the total volume of inpatient hospital admissions from December 31, 2017 to December 5, 2020 involving patients who were either discharged or in Died January 13, 2021. Data is aggregated weekly and summarized by 34 US health organizations representing 97 hospitals in 26 states and covering 20 million patients. These states represent 73.0% of the COVID-19 cases as of January 21, 2021, and also represent 76.7% of the US population. The predicted volume was calculated using historical data from December 31, 2017 to January 25, 2020. COVID-19 recordings were identified as recordings with either a documented COVID-19 diagnosis (U07.01) or another respiratory diagnosis involving a patient who had either tested positive or suspected positive for COVID-19 or received within a COVID-19 diagnosis within 14 days of admission.

Background and previous studies on health trends 2020

Several recent studies show that as of March 2020, social distancing measures, concerns about hospital capacity, and fears of catching COVID-19 resulted in a sharp drop in healthcare spending. In all health services, excluding pharmaceuticals, spending decreased by 32% on an annual basis in April 2020 compared to April 2019. Health service spending has increased since then and year on year since the third quarter of 2020 Health service spending decreased by 2, 4% down (compared to year-to-date spending from the third quarter of 2019). The changes in spending since the beginning of the year have varied depending on the type of service. Doctor's office income declined 4.0% through Q3 2020 and hospital income decreased 1.7% (compared to year-to-date spending from Q3 2019).

A recent EHRN analysis of the EMR data found patterns similar to those presented here for visits to the entire emergency department (ED), with a sharp decrease (around 50% of the predicted ED visit volume) followed by a slight decrease Recovery with total ED visits still at around 65-70% of the forecast volume as of early December 2020. Breaking down ED visit patterns by specific conditions also found trends in visits with more severe (i.e. historically more admitted) Conditions are connected. B. Stroke and Acute Myocardial Infarction, saw a smaller decline and recovered to predicted levels faster in Spring 2020 than visits related to less serious conditions such as dermatitis and conjunctivitis. Analysis of EMR data for breast, cervical, and colon cancer screenings showed an even greater decline from early March, followed by an increase in screenings. Even so, screening rates remained well below 2019 levels. By mid-June, weekly volumes for these cancer screenings were about 30-35% below their pre-COVID-19 levels.

Results

Trends in total hospital admissions

Our analysis of the EMR data shows a steep decline in hospital admissions from the week ending March 14, 2020, falling to a low of 69.2% of projected admissions in the week ending April 4, 2020 (Figure 1) – short after March 13th. National Emergency Proclamation 2020. Soon after that date, admissions began to increase, and by July 4, 2020, admissions were back at about 95% of their forecast levels, hovering around 93-95% in October and November.

Figure 1: Total registrations fell in March and April but have remained above 90% since June

The decline in registrations between March 8 and December 5, 2020 represents 8.5% of the total number of registrations forecast in the 2020 calendar year. If the number of approvals stayed at around 94% of forecast approvals by the end of 2020 (as it was on December 5), the total number of approvals would be 8.9% below the forecast volume for the full year.

IMPACT ON HOSPITAL FINANCES

That drop in admissions was not expected earlier in the year, and the sharp drop in admissions at the start of the pandemic may have been difficult for some hospitals to manage. The financial strength of hospitals varies greatly. A recent study found that in 2018, the medium hospital had enough cash to pay its operating costs for 53 days, while the 25th percentile hospital only had enough cash for 8 days. Smaller hospitals, public hospitals, and rural hospitals are most likely to face financial challenges due to the lost revenue associated with COVID-19. Some of these hospitals may be closed or merged if they do not have the financial means to offset decreases in sales caused by the decreases in admissions reported in our data.

Hospitals and other health care providers have qualified for various types of federal aid during the coronavirus pandemic. However, much of this money was not originally intended for safety net hospitals, which operated on tight margins. Hospitals and other health care providers in particular received grants from the $ 178 billion relief fund distributed by the Department of Health and Human Services (HHS). Hospitals qualified for grants that were at least 2% of sales and received grants averaging approximately 5.6% of sales. Hospitals that qualified for additional grants either qualified to have high numbers of inpatient COVID-19 patients treated by June 10, or were children's hospitals, rural hospitals and / or hospitals with safety nets. There is approximately $ 26 billion available for future grant allocations through February 3, 2021.

In the Coronavirus Stimulation Bill that went into effect on December 27, 2020, Congress stipulated that 85% of the remaining money must be used to reimburse providers for the loss of income or expenses caused by the coronavirus pandemic. However, it is not clear how the decline in admissions translates into lost revenue for hospitals, which depends on the type of missed admissions and which insurers paid for those admissions. Private insurers usually reimburse at higher rates than Medicare or Medicaid, and reimbursement varies widely depending on the type of authorization.

Hospitals and other providers participating in traditional Medicare were also eligible for loans under Medicare Accelerated and prepayment programs, designed to help hospitals face disruptions in cash flow in the event of an emergency. About 80% of the $ 100 billion in loans went to hospitals. CMS started distributing the loans in March 2020. Repayment of the loans was originally scheduled to begin in August, but Congress later delayed the start of repayments and extended the repayment deadline. Providers will now begin repaying the loans one year after receiving their first loan payment, which means that repayment should begin in March 2021.

Additionally, Medicare has increased hospital payments for all COVID-19 inpatients by 20% during the current public health emergency. The Biden administration has indicated that the public health emergency is expected to persist through 2021. The Congressional Budget Bureau originally estimated that this change will add about $ 3 billion to Medicare spending. Hospitals can also obtain loans that are granted by the Treasury Department, the Federal Reserve, and the Small Business Administration.

IMPACT ON INSURANCE FINANCES

In contrast, health insurers have benefited financially from this decline in hospital admissions and certain other medical benefits since the pandemic began. The KFF analysis found that by the end of the third quarter of 2020, the average gross margins of health insurers had increased compared to 2019 and 2018 in the single market, group market, Medicare Advantage and Medicaid managed care markets. KFF's analysis also looked at trends in medical claims ratios, or the percentage of premium income that insurers pay out in the form of medical claims. In general, lower medical claims ratios mean that after medical expenses are paid, insurers have more income to use for administrative expenses or to keep as profit. Compared to the same period in 2019, the average claims ratios in Q3 2020 were lower in the Single Market, Group Market, Medicare Advantage and Medicaid Managed Care markets.

Trends in non-COVID-19 approvals

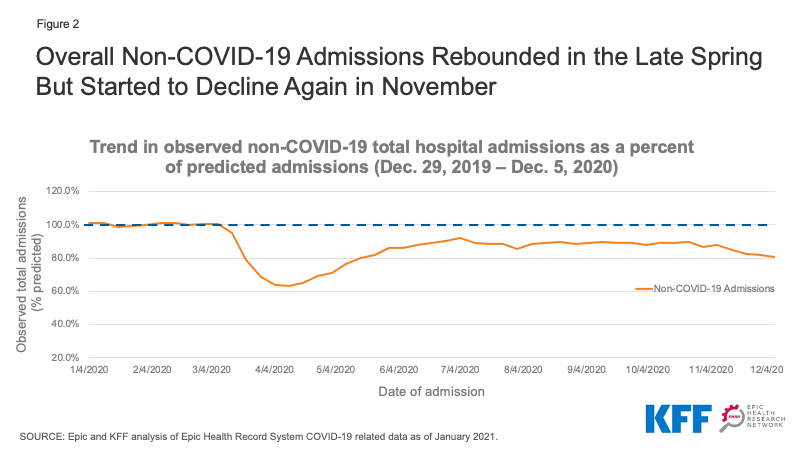

We used EMR data from EHRN to examine general trends in non-COVID-19 admissions, and particularly non-COVID-19 admissions, by gender, age and region of the patient. By specifically addressing non-COVID-19 approvals, we can more easily assess declines in health care use due to voluntary and mandatory delays in non-emergency care. Looking at the general trends, we found that non-COVID-19 approvals hit a low of 63.4% of projected approvals in the week ended April 11, 2020 (Figure 2). By June 2020, non-COVID-19 approvals had risen and in the week ended July 4, 2020, they peaked at 92.0% of the forecast values. However, they soon fell again after COVID-19 approvals began to rise again in the fall and fell to around 80% of the forecast levels by the week ending December 5, 2020.

Figure 2: The total number of non-COVID-19 approvals rebounded in late spring but declined again in November

Our analysis does not contain specific diagnoses or procedures for assessing which types of recordings have declined the most. Declines in certain types of approvals – such as B. Car accidents – can be explained by changes in habits due to the coronavirus pandemic. As discussed earlier in this article, declines in cancer screenings suggest that the overall decline in admissions is also a sign that patients are delaying or doing without screening and therefore not starting the necessary treatments. Some cancer treatments were also delayed earlier in the pandemic, although these treatments have now resumed in many cases. In other cases, hospitals have delayed or canceled non-emergency procedures due to capacity constraints.

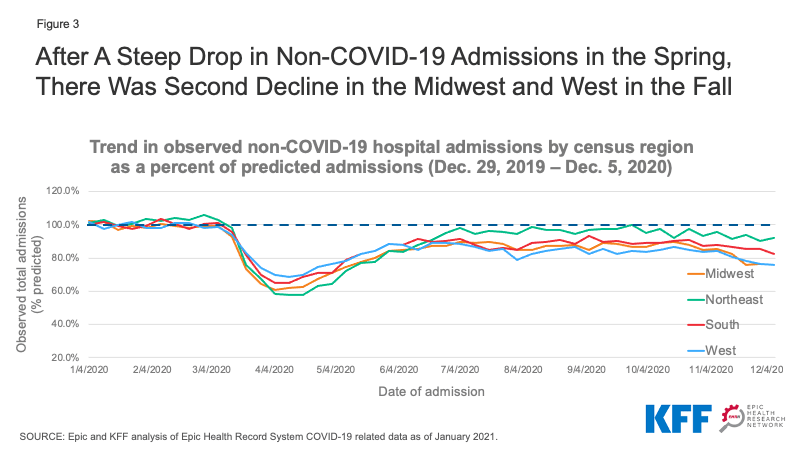

Non-COVID-19 Approvals by Region

We used the regions defined by the U.S. Census Bureau to examine how non-COVID-19 approval trends differed across geographic regions. To give an idea of the geographic distribution of our dataset, approvals from the Northeast, Midwest, South, and West regions account for approximately 24%, 25%, 28%, and 23% of the total approvals, respectively. While there was a sharp drop in COVID-19 approvals in all regions at the beginning of the pandemic, followed by a recovery, the smaller drop in non-COVID-19 approvals in November and early December 2020 was not uniform across the country. Non-COVID-19 admission to hospitals as a percentage of forecast volume went from 85.5% to 76.0% in the Midwest and from 84.3% to 75 between the weeks of November 7th to December 5th, 2020, 7% in the west (Figure 3). In the same month, COVID-19 cases increased in many parts of these regions. The hospitals in the south rose from 87.8% of the forecast non-COVID-19 volume to 82.3% over the same period. Meanwhile, hospitals in the northeast had seen the sharpest drop in non-COVID-19 admissions at the start of the pandemic, but non-COVID-19 admissions remained at higher levels than other regions in the fall of 2020, at 91.2% the forecasted values band of the week through December 5, 2020.

Figure 3: After a sharp drop in non-COVID-19 approvals in the spring, there was a second drop in the Midwest and West in the fall

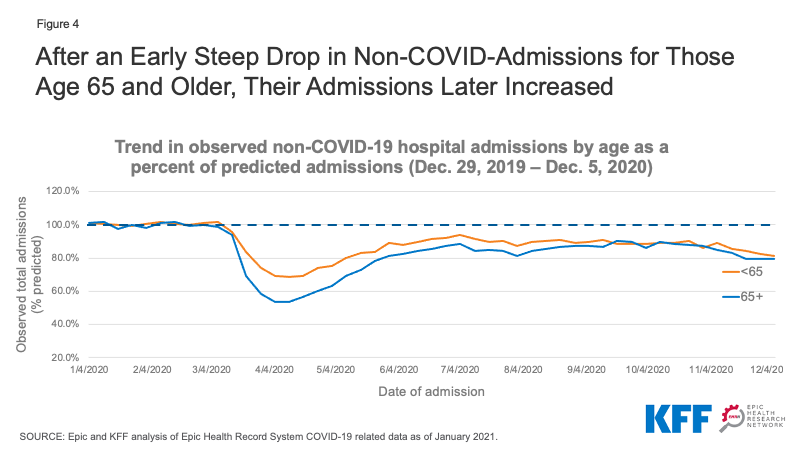

Non-COVID-19 approvals by age

We stratified the EHRN admissions data by age to assess trends in non-COVID-19 admissions for patients 65 years of age and older compared to younger patients. We found that the enrollment of patients 65 and older in April 2020 was only 53.4 to 63.0% of the predicted values, compared with 68.6 to 75.1% of the predicted values for younger patients (Figure 4). This could suggest that older patients at higher risk of serious illness or death from COVID-19 are more likely than younger patients to be reluctant to enter hospital when not strictly necessary. Non-COVID-19 admissions recovered more slowly in older patients than younger ones, but by September both age groups had reached about 88% of the predicted admissions. In the week ending December 5, 2020, non-COVID-19 admissions decreased again to 81.5% of the predicted admissions for patients under 65 and 79.2% for patients 65 and over.

Figure 4: After a sharp early drop in non-COVID approvals for people 65 and over, their approvals later increased

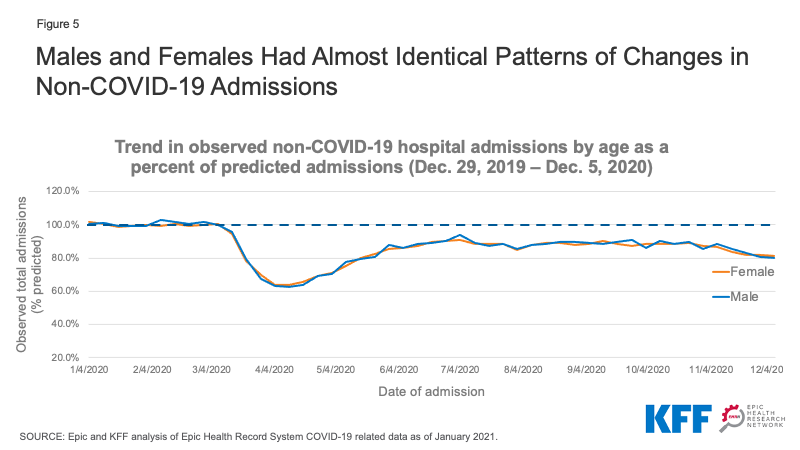

Non-COVID-19 approvals by gender

Non-COVID-19 uptake for both male and female patients decreased to about 65% of the predicted admissions in April 2020 and then rose to about 85-90% of the predicted admissions by the summer (Figure 5). In November, non-COVID-19 shots for both men and women fell slightly to around 80% of the predicted shots. At the absolute level, uptakes remained about 20% higher in female patients than in male patients (data not shown). Much of this difference is likely due to the intake of women into childbirth.

Figure 5: Men and women had almost identical patterns of change in non-COVID-19 admissions

Implications

This updated analysis from the Epic Health Research Network provides additional insight into the patterns of hospital admissions during the COVID-19 pandemic – and the impact trends in COVID-19 cases have on non-COVID-19 admissions. If we look at the patterns in non-COVID-19 recordings, we can see how behavior changes affected differently by region, age, and gender. The non-COVID-19 approvals identified in the fall of 2020 suggest that people may be delaying supplies in ways that could be detrimental to their long-term health. The effects of this lack of care will be an important topic for future analysis.

Tyler Heist, Ph.D. and Sam Butler, M.D., are with the Epic Health Research Network. Karyn Schwartz, M.P.H., is with KFF.

Comments are closed.